No matter your credit status – whether building from scratch or rebuilding from missteps – understanding how your scores are determined can help you formulate an action plan to increase them. Experian, TransUnion and Equifax calculate scores using various criteria; payment history, amount owed, credit utilization rate, length of history used and credit mix comprise most of your score; while personal information like income or address don’t impact it directly.

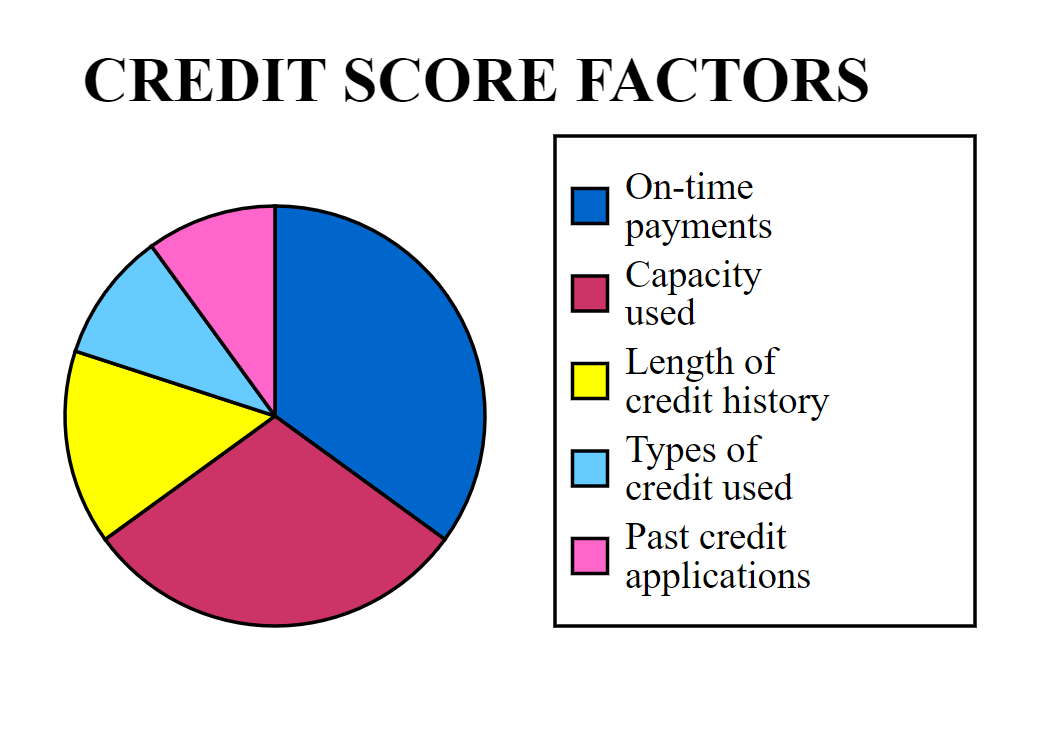

Your payment history accounts for 35% of your score. This factor includes whether or not you consistently make on-time payments and any past late or missed payments, and consider setting reminders or automating automatic payments so as to not miss due dates. Also contributing significantly (30%) is keeping your credit utilization ratio low (the ratio between how much debt you owe vs total available credit you have on accounts), which you can do by cutting spending or asking for an increase on one or more cards.

Length of Your Credit History | FICO(r) Score | Experian(r) The length of your credit history accounts for 15% of your score, and includes how long different kinds of accounts have existed and their average age. Opening new accounts could temporarily decrease this average age; so be mindful when considering new loans or credit cards to open.

Your credit mix makes up the last 10% of your score and looks at all of the different accounts that make up your financial life, such as installment loans (like car or student loans ) and revolving credit accounts such as credit cards. Lenders prefer seeing an array of these types of accounts to show that you can responsibly manage both fixed-rate debt and revolving credit debt.

Your credit scores are dynamic; they change as information in your report changes, so taking steps to enhance your credit can have an immediate effect on its score. For more insight into how credit scoring works and what can impact it positively, read “Understanding Your Credit Score: What Affects It and How to Improve It”.